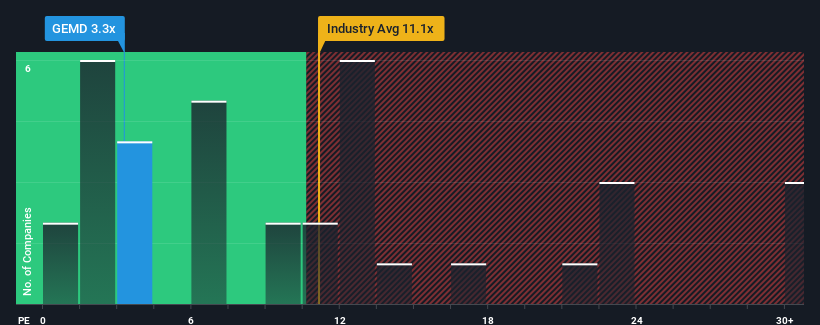

Gem Diamonds Limited’s low price-to-earnings (P/E) ratio of 3.3x is causing quite a stir in the market. While most companies in the United Kingdom have P/E ratios greater than 15x, Gem Diamonds’ low P/E suggests some skepticism from investors. The company has been struggling with declining earnings, and this lackluster performance has dampened investor enthusiasm. However, even though the recent earnings have been disappointing, there is potential for medium-term growth. This article explores the factors contributing to Gem Diamonds’ low P/E and delves into the implications for investors.

Overview of Gem Diamonds Limited’s Performance

Gem Diamonds Limited, a diamond mining company, has been experiencing a lackluster performance that is reflected in its low price-to-earnings (P/E) ratio. The current P/E ratio of 3.3x is significantly lower than the average P/E ratio of other companies in the United Kingdom, which often exceed 15x or even 28x. This suggests that Gem Diamonds may be undervalued in the market. However, a deeper analysis is required to understand the reasons behind this low P/E ratio.

Explanation of Gem Diamonds Limited’s current P/E ratio

The P/E ratio is a valuation metric that compares the price of a company’s stock to its earnings per share (EPS). A low P/E ratio suggests that the market has lower expectations for the company’s future earnings. In the case of Gem Diamonds, the low P/E ratio indicates that investors are skeptical about the company’s ability to generate significant profits in the future.

A look at Gem Diamonds Limited’s earnings decline

Gem Diamonds’ earnings have been declining at a faster rate compared to other companies. This decline in earnings is a significant factor contributing to the company’s low P/E ratio. Investors are concerned about the company’s ability to reverse this trend and generate sustainable profits in the future.

Expectations of dismal earnings performance to persist

The market sentiment towards Gem Diamonds is pessimistic, with many expecting the company’s earnings performance to continue to deteriorate. This expectation of poor earnings performance in the future has further suppressed the company’s P/E ratio. Investors are cautious about investing in Gem Diamonds due to the uncertain outlook for the company’s profitability.

Discussion on the future direction of the Gem Diamonds Limited share price

Given the current circumstances, it is understandable that existing shareholders may struggle to feel excited about the future direction of Gem Diamonds’ share price. The company’s low P/E ratio reflects the market’s skepticism towards its future growth prospects. Shareholders may have to wait for a significant improvement in the company’s earnings performance before seeing a substantial increase in the share price.

Comparison of Gem Diamonds Limited’s P/E Ratio to the Industry

Examination of Gem Diamonds Limited’s P/E ratio compared to other companies in the UK

When comparing Gem Diamonds’ P/E ratio to other companies in the United Kingdom, it becomes apparent that the company’s ratio is much lower than the industry average. This suggests that the market has less confidence in Gem Diamonds’ future earnings potential compared to its industry peers.

Reasoning behind Gem Diamonds Limited’s highly reduced P/E ratio

The highly reduced P/E ratio of Gem Diamonds can be attributed to the company’s earnings decline and the market’s pessimistic outlook. Investors are hesitant to pay a premium for Gem Diamonds’ stock given the company’s current financial performance and uncertain future prospects.

Discussion on the broader market’s P/E ratios

The broader market’s P/E ratios serve as a benchmark for evaluating a company’s valuation. If Gem Diamonds’ P/E ratio is significantly lower than the market average, it indicates that the market has lower expectations for the company’s future earnings growth compared to the overall market. This discrepancy reflects the market’s perception of Gem Diamonds’ current and future performance.

Gem Diamonds Limited’s Earnings Growth

Description of the decrease in the company’s bottom line over the last year

Gem Diamonds has experienced a significant decrease in its bottom line over the past year. This decline in earnings has negatively impacted the company’s financial performance and investor confidence.

Examination of EPS growth from three years ago

Despite the recent decline in earnings, Gem Diamonds has shown impressive EPS growth over the past three years. The company’s EPS has increased by 707% during this period, indicating a strong performance in the past. However, the recent decline in earnings has raised concerns about the sustainability of this growth.

Prediction of EPS growth over the coming three years based on analyst forecasts

According to analysts’ forecasts, Gem Diamonds’ EPS is expected to grow by 4.4% annually over the next three years. This projected growth rate is significantly lower than the expected 11% per year growth rate for the broader market. The market’s anticipation of slower earnings growth for Gem Diamonds is reflected in its low P/E ratio.

Gem Diamonds Limited’s Projected Future Performance Compared to the Market’s

Comparison of Gem Diamonds Limited’s anticipated growth with the broader market forecast

When comparing Gem Diamonds’ anticipated growth with the forecast for the broader market, it becomes evident that the company is expected to underperform. The market expects slower earnings growth for Gem Diamonds, which is reflected in the company’s low P/E ratio.

Analysis of the impact of the company’s less prosperous future on its share price

The expectation of a less prosperous future for Gem Diamonds has had a negative impact on its share price. Investors are reluctant to pay a premium for the company’s stock due to concerns about its ability to generate sustainable profits. As a result, the share price is unlikely to experience significant growth in the near future.

Interpretation of Gem Diamonds Limited’s Low P/E Ratio

Explanation of the influence of forecast growth on Gem Diamonds Limited’s P/E

Gem Diamonds’ low P/E ratio can be attributed to the market’s perception of the company’s forecasted growth. The market expects slower earnings growth for Gem Diamonds compared to the broader market, leading to a lower valuation for the company’s stock.

Analysis of market participant perceptions captured by the P/E ratio

The P/E ratio reflects market participants’ perceptions of a company’s future earnings potential. In the case of Gem Diamonds, the low P/E ratio suggests that investors have limited confidence in the company’s ability to generate significant profits in the future. This perception is driven by the company’s recent earnings decline and the market’s expectation of continued poor performance.

Shareholder response to the low P/E

Shareholders are likely to be concerned about the company’s low P/E ratio. The low valuation indicates that the market does not have high expectations for the company’s future earnings growth. Shareholders may need to reassess their investment decision and carefully evaluate the company’s prospects before making any further investment decisions.

Potential for Share Price Growth

Speculation on the possibility of share price rising in the near future

Given the current circumstances and the market’s skepticism towards Gem Diamonds, it is unlikely that the share price will experience significant growth in the near future. The company’s low P/E ratio and the expectation of slower earnings growth make it challenging for the share price to rise substantially.

Impact of foreseeable future earnings performance on share price growth

The foreseeable future earnings performance of Gem Diamonds will play a significant role in determining the share price growth. If the company can turn around its earnings decline and demonstrate sustainable profitability, there is a possibility of share price growth. However, if the earnings performance continues to deteriorate, the share price may remain stagnant or even decline further.

Investment Risk Associated with Gem Diamonds Limited

Identification of warning signs for Gem Diamonds Limited

There are warning signs associated with investing in Gem Diamonds. The company’s recent earnings decline, low P/E ratio, and the pessimistic market sentiment are all indicators of potential investment risks. It is important for investors to carefully evaluate these risks before making any investment decisions.

Explanation of the risks’ role in investment decision-making process

Risks play a crucial role in the investment decision-making process. Understanding the risks associated with a company, such as Gem Diamonds, allows investors to make informed decisions and manage their investment portfolio effectively. Evaluating the risks helps investors assess the potential returns and weigh them against the potential losses.

Exploring Other Investment Opportunities

Presentation of other high-quality stocks as alternatives

Investors looking for alternative investment opportunities may consider exploring other high-quality stocks in the market. By diversifying their portfolio and investing in other companies with better growth prospects, investors can mitigate the risks associated with Gem Diamonds’ low performance.

Discussion on reconsideration of opinions on Gem Diamonds Limited

Considering the lackluster performance of Gem Diamonds and the associated investment risks, investors may need to reconsider their opinions on the company. It is essential to evaluate the company’s future prospects and compare them with other investment opportunities to make well-informed decisions.

Valuation of Gem Diamonds Limited

Introduction to comprehensive analysis of Gem Diamonds Limited’s valuation

A comprehensive analysis of Gem Diamonds’ valuation involves considering various factors such as fair value estimates, risks, dividends, insider transactions, and financial health. This analysis provides investors with a holistic view of the company’s value and helps them assess its investment potential.

Exploration of factors such as fair value estimates, risks, dividends, insider transactions, and financial health

To determine Gem Diamonds’ valuation, factors such as fair value estimates, risks, dividends, insider transactions, and financial health need to be explored. This comprehensive analysis provides investors with valuable insights into the company’s potential and helps them make informed investment decisions.

Conclusion

Gem Diamonds Limited’s lackluster performance, reflected in its low P/E ratio, is driving investor sentiment. The company’s earnings decline and the market’s expectation of continued poor performance have contributed to the low valuation. Shareholders may face challenges in the future as the company struggles to generate sustainable profits. It is important for investors to evaluate the risks and consider alternative investment opportunities before making any further decisions.