Petra Diamonds Limited: A Favorite Among Large Institutional Investors

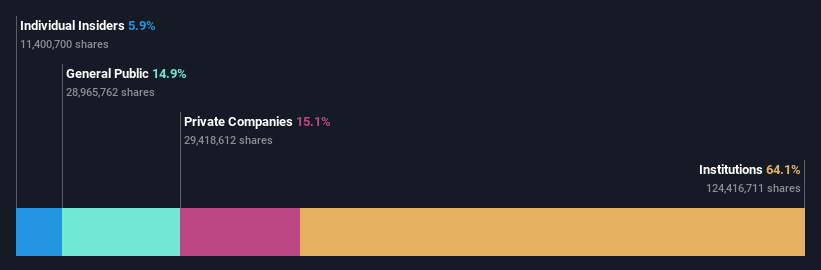

Petra Diamonds Limited: A Favorite Among Large Institutional Investors. Here’s a sparkling glimpse into a gem of an investment opportunity: Petra Diamonds Limited, a favorite among large institutional investors. With a substantial 64% of the company held by these major players in the global financial market, Petra Diamonds Limited (LON:PDL) shines bright in their portfolio selections. The identity of these specific investors may not be on record, but their high turnout clearly signals Petra Diamonds Limited as a noteworthy contender in the investment arena.

Overview of Petra Diamonds Limited

Petra Diamonds Limited is a multinational gem-mining company headquartered in London. With several mining operations running across the African continent, this corporation is known for its vast array of exquisite, high-quality diamonds.

Company Background

Petra Diamonds emerged onto the diamond mining scene in 1997. Its founder, Adonis Pouroulis, saw an opportunity within the market in the wake of De Beers’ decline as the world’s dominant player. The company gradually established a firm footing, acquiring stakes in promising mines primarily in South Africa and Tanzania.

Key Executives

The team leading Petra Diamonds boasts a wealth of experience in mining, business, and finance. The Board of Directors is headed by Adonis Pouroulis, acting as Non-Executive Chairman. On the day-to-day operations, Richard Duffy, the Chief Executive Officer, brings over 25 years of mining industry experience to the company.

Scope of Operations

Petra Diamonds operates across an impressively wide region, with productive mines spread across Southern Africa. These facilities look to the extraction and processing of raw diamonds, which the company then sells on the international market. Their products range from traditional clear diamonds to a unique selection of colored diamonds, globally sought after for their rarity and beauty.

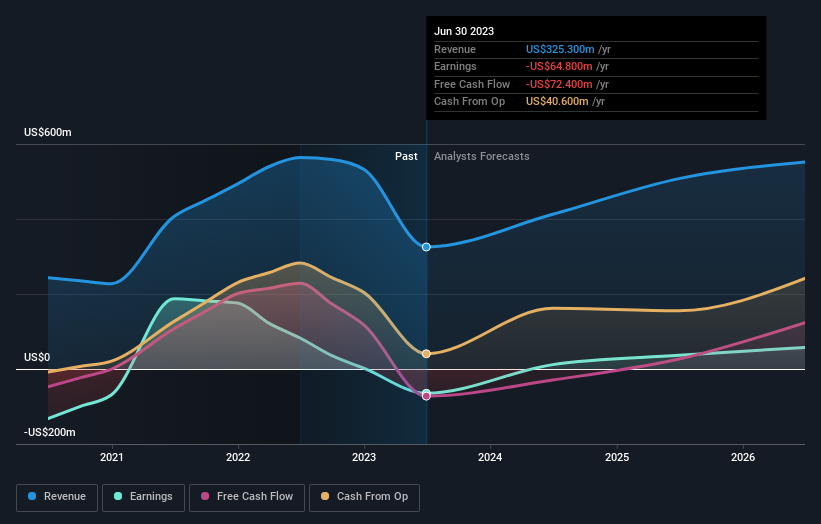

Summary of Financial Performance

Despite the challenges the mining industry faces, Petra Diamonds Limited has shown quite a remarkable financial performance. The company reported robust revenues over recent years, underlining its ability to thrive in an intensely competitive market.

Institutional Investor Profile

Institutional investors have an immensely influential role in the financial community. They are known for their purchasing power and strategic investments across different sectors. Their involvement in a company is often perceived as a positive signal.

Understanding Institutional Investors

Institutional investors refer to entities that pool money to purchase stocks, bonds, and other securities. These can be banks, insurance companies, pensions, hedge funds, REITs, investment advisors, and endowments. Characterized for leveraging large amounts of capital and participating in private placements, these investors differ from individual or retail investors in terms of the volume of trades.

Role in Financial Markets

Their presence holds a colossal impact on financial markets as they account for over half of the trading volume in the U.S. stock market. By buying massive amounts of shares and securities, they command a certain level of influence in deciding the trajectory of financial markets.

Impact on Stock Prices

Given the size of their portfolios, the trading activity of institutional investors can significantly influence stock prices. A high demand from institutional buyers often encourages a bullish sentiment, leading to rising prices and vice versa.

Petra Diamonds’ Performance in the Stock Market

Petra Diamonds has been a noteworthy participant in the stock markets. With a history marked by periods of both gains and declines, the company intrigues investors worldwide.

Share Price Movements

The shares of Petra Diamonds have undergone various movements over the years. Seasoned investors know that these fluctuations are a common trait in the stock market and can indicate market sentiment towards a particular company.

Market Capitalization

Market capitalization – or the total market value of a company’s outstanding shares of stock – is a standard measure of a company’s size and growth potential. Petra Diamonds’ market cap has been subject to shifts, reflecting business performance, financial results, and market perception.

Volume and Volatility

Traded volume and volatility are critical for investors when monitoring stock performance. Trading volume gives an idea of the stock’s liquidity, while volatility can help gauge the stock’s price changes, reflecting its risk and return trade-offs.

Institutional Investors in Petra Diamonds

Institutional investors have shown a significant amount of interest in Petra Diamonds. With these entities owning over half of the company, their involvement has implications on the company’s operations and financial standing.

Proportion of Holdings

Large institutional investors own approximately 64% of Petra Diamonds. Although the specific investors have remained unnamed in reports, such a substantial ownership percentage underscores the wide-scale confidence in the company’s potential.

Reasons for Large Institutional Investment

The substantial institutional ownership reflects positively on Petra Diamonds. It can be interpreted as a strong endorsement of the business’s health, strategic direction, and financial prospects.

Implications of High Institutional Ownership

High institutional ownership may bring about stability in the company’s shareholder base. These investors are typically long-term oriented, providing a level of predictability and resilience to the share price.

Analysis of Petra Diamonds’ Business Model

Understanding Petra Diamonds’ business model can help in assessing its strengths and possible future performance.

Revenue Streams

The company’s primary revenue stream comes from its diamond mining operations. By strategically managing its resources and partnerships, Petra Diamonds has been able to maintain a reliable cash inflow despite fluctuations in global diamond prices.

Cost Structure

The cost structure for Petra Diamonds primarily includes operational costs related to mining, like labor and equipment, and other expenses like transportation and marketing. Its financial strategy focuses on managing these efficiently.

Differentiating Factors

Petra Diamonds’ standing in the industry can be attributed to exclusive factors such as the quality and uniqueness of its diamond reserves, the effectiveness of its mining techniques, and the strength of its relationships with diamond buyers.

Financial Health of Petra Diamonds

A comprehensive examination of Petra Diamonds’ financial health is instrumental in forming a complete investment perspective.

Analysis of Key Financial Ratios

Financial ratios such as the debt-to-equity ratio, current ratio, and return on equity provide insights into the company’s ability to meet financial obligations, its liquidity status, and its profitability relative to shareholder funds.

Debt Levels

While debt is common for many companies to fuel growth, it’s crucial to consider the company’s ability to handle its debt levels. Thus, insight into Petra Diamonds’ leverage is crucial.

Profitability Assessment

Profitability ratios like gross margin ratio, net profit margin, and return on assets denote the company’s efficiency in generating profits. It gives valuable insight into the company’s operational efficiency and its capacity to drive earnings in comparison to its costs and expenses.

Risk Factors for Institutional Investors

Investing in any enterprise, including Petra Diamonds, comes with its set of risks. These risks can be broadly classified into market, operational, and regulatory risks.

Market Risks

Market risks refer to potential losses due to factors that affect the overall performance of financial markets. In Petra Diamonds’ context, this could mean fluctuations in the global diamond market or unfavorable economic conditions.

Operational Risks

These are risks associated with the company’s day-to-day operations. For Petra Diamonds, this might include risks associated with mining, labor disputes, or disruptions in the supply chain.

Regulatory Risks

Regulatory risks involve the potential negative effects of new laws or regulations. As Petra Diamonds operates globally, it has to comply with various laws and regulations of all the countries it operates in.

Petra Diamonds’ Growth Prospects

Petra Diamonds holds promise for future growth. Although it’s essential for investors to weigh both short- and long-term prospects, the company’s past successes suggest its potential.

Short-Term Forecast

Because of market fluctuations and uncertainties, short-term forecasts can be unpredictable. Yet, recognizing industry trends and understanding the company’s strategic choices can give some indications.

Long-Term Prospects

Petra Diamonds’ long-term prospects appear promising. Its financial health, combined with the strength of its business model, suggests potential for stable returns over time.

Investment Potential

Given the robust institutional investor interest, favorable growth prospects, and viable business strategy, Petra Diamonds seems to possess significant investment potential.

The Impact of Institutional Investors on Petra Diamonds

Institutional investors play a considerable role in shaping a company’s prospects. Their influence has a tangible impact on Petra Diamonds’ business decisions, stock market perception, and financial stability.

Influence on Company Decisions

The high level of institutional ownership means they have a more significant say in the company’s decisions. They have the power to influence corporate policies, financial decisions, and potentially even the strategic direction of the business.

Effect on Stock Market Perception

The active presence of institutional investors can improve the perception of Petra Diamonds’ stocks in the market. Their investments are often seen as a sign of confidence in the company’s future.

Contribution towards Financial Stability

Institutional investors may provide Petra Diamonds with financial stability. Their long-term investment approach allows the company to plan for its future development extensively. EU to Consider Banning Sale of Russian Diamonds

Conclusion: Why is Petra Diamonds a Favorite among Institutional Investors

The large scale institutional interest in Petra Diamonds can be attributed to its unique selling proposition, strong financial performance, and promising growth prospects.

Unique Selling Proposition

Petra Diamonds offers something unique – a diverse portfolio of diamonds from some of the rarest sources across Africa. The company’s exceptional product line makes it attractive to institutional investors. https://www.gia.edu/gia-bangkok

Strong Financial Performance

The company’s strong financial performance indicates it has successfully navigated the diamond mining industry’s challenges. This profitability makes Petra Diamonds an appealing choice for institutional investors.

Promising Growth Prospects

Lastly, Petra Diamonds demonstrates significant growth prospects. The combination of its flourishing financial health, market position, and strategic decisions position the company well for future expansion. In essence, these factors make Petra Diamonds an attractive investment to institutional investors, explaining the remarkable institutional ownership in the company.